World’s top 10 billionaires get richer after Trump's re-election

Elon Musk, Jeff Bezos, and Larry Ellison lead “the biggest daily increase” of $64 billion

In a historic market reaction to Donald Trump’s re-election, the fortunes of the world’s 10 richest individuals surged by an unprecedented $64 billion on Wednesday.

Trump, 78, secured his second term in the White House, with his victory bringing renewed expectations of a pro-business agenda that investors believe will foster lower taxes and reduced regulation, further benefiting corporate giants and the financial elite.

According to Bloomberg’s Billionaires Index, US stocks rallied following Trump’s win as investors banked on a return to deregulation and favourable business policies, substantially boosting the wealth of billionaire investors. “US financial assets, especially equities and the US dollar, should experience a boost,” Lombard Odier’s Samy Chaar, chief economist and CIO for Switzerland, and Luca Bindelli, head of investment strategy, wrote in a note to the wealth manager’s clients.

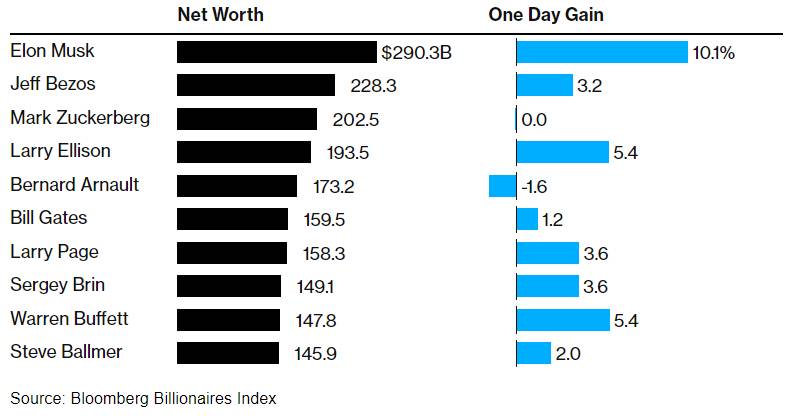

Tesla CEO Elon Musk, the world’s richest person and an outspoken Trump supporter, led the gains with an astonishing $26.5 billion rise in wealth, bringing his net worth to $290 billion.

Amazon founder Jeff Bezos saw his fortune swell by $7.1 billion, while Oracle co-founder Larry Ellison, also a Trump backer, enjoyed a $5.5 billion boost in net worth, Bloomberg reports.

Other billionaires among the top 10 to profit included Microsoft’s Bill Gates and Steve Ballmer, Google’s Larry Page and Sergey Brin, and Berkshire Hathaway CEO Warren Buffett. Although none of these ultra-wealthy executives endorsed a candidate this year, many have previously expressed support for Democratic policies.

According to Bloomberg, the $64 billion gain represents “the biggest daily increase” in billionaire wealth since the index began in 2012. The surge underscores the positive market response to Trump’s second term, with expectations that his policies will promote a business-friendly environment.

Market surge expected under Trump admin

Wednesday’s election result sent the S&P 500 soaring by 2.5%—its strongest post-election performance in US history—while the US dollar also gained. Investors are optimistic about a Trump administration that could deliver a “business-friendly, tax-friendly regime.” Expectations of a Republican-led Senate to advance Trump’s agenda of deregulation and tax cuts have bolstered hopes for continued gains, particularly in equities and other US financial assets.

The market’s rapid rise also underscores the influence of billionaires in US financial systems, with the top 10 holding substantial shares in booming sectors such as technology, media, and finance.

Only one of the wealthiest individuals, Bernard Arnault, chairman of luxury goods giant LVMH, is based outside the United States.

Crypto billionaires among major gainers

In addition to Musk and Ellison, several prominent figures in the cryptocurrency industry saw notable gains. Brian Armstrong, co-founder and CEO of Coinbase, experienced a 30% increase in net worth, reaching $11 billion.

Changpeng Zhao, founder of Binance, the world’s largest crypto exchange, added $12.1 billion to reach a net worth of $52.7 billion, Bloomberg reports.

Trump’s own stake rises with media surge

In a parallel boost, Truth Social owner Trump Media & Technology Group saw its shares soar in value after media outlets projected Trump’s re-election. Trump, the dominant shareholder in the company, briefly held $5.3 billion worth of shares, up from $3.9 billion at the close of Election Day. His 114.75 million shares spiked in value as much as 35% during Wednesday’s trading session, according to Bloomberg.

This extraordinary boost in billionaire wealth highlights the market’s response to Trump’s pro-business stance and hints at potential economic shifts under his administration’s policies. Bloomberg’s analysis reveals that the world’s wealthiest are cashing in on the renewed expectations for a friendlier landscape for major investments and corporate interests alike.