UAE strengthens Anti-Money Laundering and Counter-Terrorism Financing laws

Businesses must be aware of these changes and take proactive steps to ensure compliance with the evolving regulatory landscape.

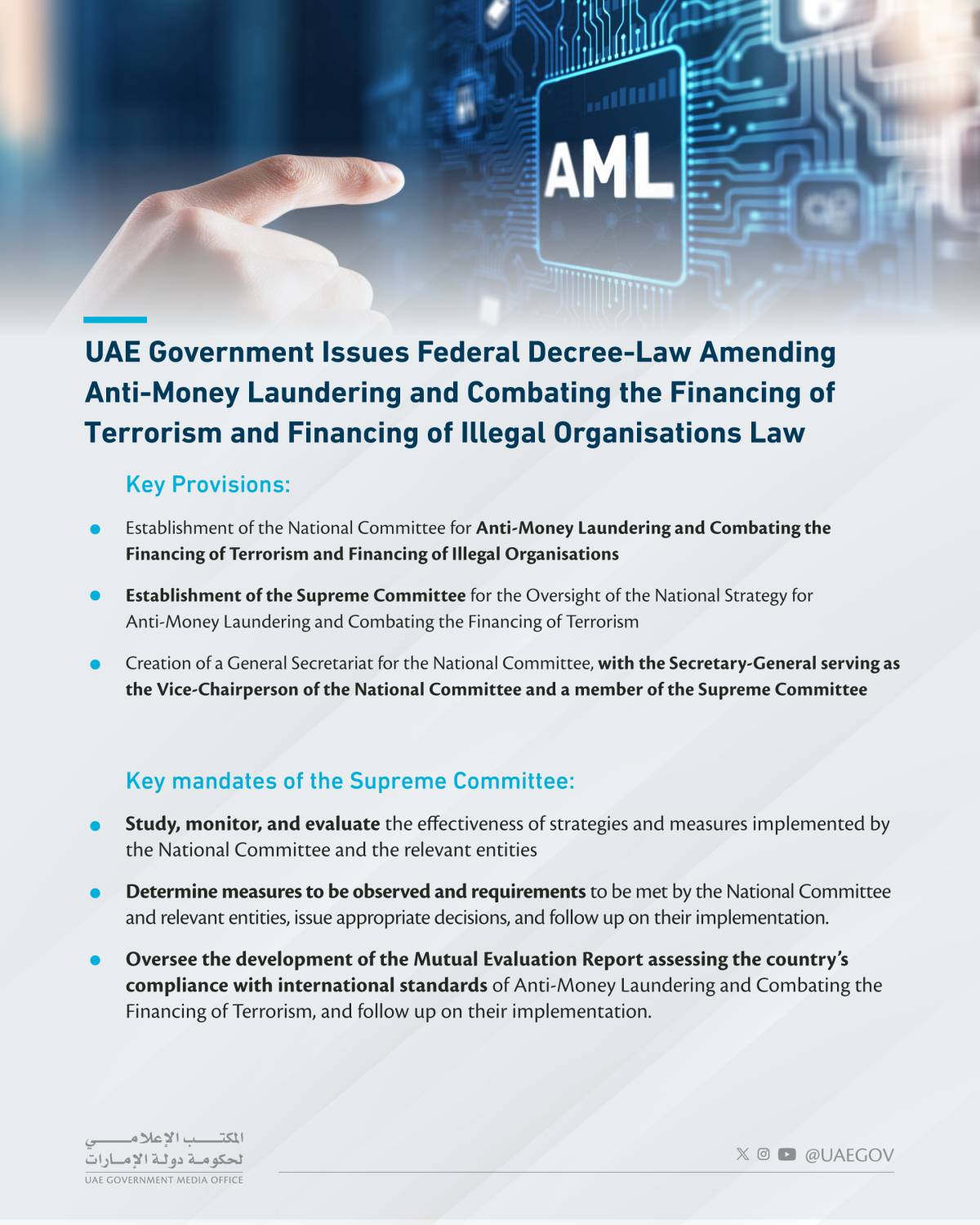

Dubai: UAE's recent amendments to its Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) law are a significant step towards strengthening the country's financial integrity. While the changes may seem subtle, they have far-reaching implications for businesses operating in the UAE.

Key changes:

-

Strengthened oversight bodies: The National Committee and the Supreme Committee have been elevated to fall under the direct purview of the Cabinet and the Presidential Court, respectively, signaling their increased importance.

-

Establishment of a general secretariat: The National Committee will now have a dedicated General Secretariat to enhance its operational capabilities and ensure more consistent and effective oversight.

-

Continued enforcement actions: The UAE remains committed to enforcing AML/CFT regulations. Recent actions, such as fines and license revocations, demonstrate the authorities' resolve to maintain a robust compliance environment.

Implications for businesses

-

Increased scrutiny: Companies can expect heightened scrutiny from regulatory authorities. Compliance with AML/CFT laws will be more critical than ever.

-

Enhanced enforcement: The authorities are likely to become more active in identifying and addressing non-compliance. Businesses should be prepared for stricter enforcement actions.

-

Need for refinement: Companies need to continuously refine their AML/CFT programs to align with the evolving regulatory landscape and international standards.

Looking ahead:

The UAE's next Mutual Evaluation process with the Financial Action Task Force (FATF) will take place in 2025-2027. The authorities must demonstrate sustained efforts to achieve positive appraisals during this assessment. Key areas of focus will likely include virtual assets, information sharing, and national databases.

Commitment to international regulations and treaties

The UAE's new AML/CFT decree is a positive development that reinforces the country's commitment to combating financial crime. Businesses must be aware of these changes and take proactive steps to ensure compliance with the evolving regulatory landscape.